1. Introduction to Automated Trading for TradingView Indicators #

This guide explains how to automate trading signals generated by TradingView indicators using PickMyTrade. By connecting indicators like RSI, Bollinger Bands, or Moving Averages to automated trade execution, you can streamline your process and remove manual delays.

What This Is (and Isn’t) #

- Indicators generate signals (buy/sell conditions)

- PickMyTrade turns those signals into real trades

- No coding required

- Works with Tradovate via webhook alerts

If your indicator can trigger an alert, it can be automated.

Before You Start #

You’ll need:

- TradingView Pro / Pro+ / Premium (webhook alerts required)

- Tradovate account connected to PickMyTrade

- A TradingView indicator with alert conditions

- PickMyTrade webhook URL

- Demo account (recommended)

Basic Workflow Overview #

TradingView Indicator

→ Alert Triggered

→ Webhook Sent

→ PickMyTrade

→ Tradovate Order

TradingView decides when to trade.

PickMyTrade decides how the trade is placed.

We’ll cover everything from trade logic and alert configuration to order types and multi-account execution. If you’re looking for a video tutorial, you can also check out:

For a visual walkthrough, refer to the accompanying video:

1.1 Reverse Order and Pyramid Settings #

PickMyTrade gives you flexible control over how trades behave when signals repeat or reverse. The following table explains how existing trades are handled based on two key toggles:

| Reverse Order Close | Pyramid | What Happens to the Existing Position (If the Same Signal Is Received) | What Happens to the Existing Position (If the Opposite Signal Is Received) | What Happens to the New Signal? |

|---|---|---|---|---|

| True | False | It would be closed | It would be closed | A new signal would open a position if it’s not a close trade. |

| True | True | It would not be closed | It would be closed | A new signal would open a position if it’s not a close trade. |

| False | N/A | It would not close the trade | It would not close the trade | A new signal would open a position if it’s not a close trade. |

1.2 Note on TP, SL, TP1, and TP2 #

- TP (Take Profit): This is a predefined price level at which a trader decides to close their position to secure profits. When the market reaches this level, the position is automatically closed, locking in the profit.

- SL (Stop Loss): This is a predefined price level where the trader exits a position to limit losses. If the market price moves unfavorably and reaches the SL level, the position is closed to prevent further losses.

- TP1, TP2 (Take Profit Levels): These are multiple take profit levels used in a Partial Exit Strategy. Instead of closing the position entirely at one level (TP), a trader can set different profit-taking points. For example, TP1 might be set at a moderate level to secure part of the profit, and TP2 can be set at a higher level to capture further potential profits while still leaving part of the position open.

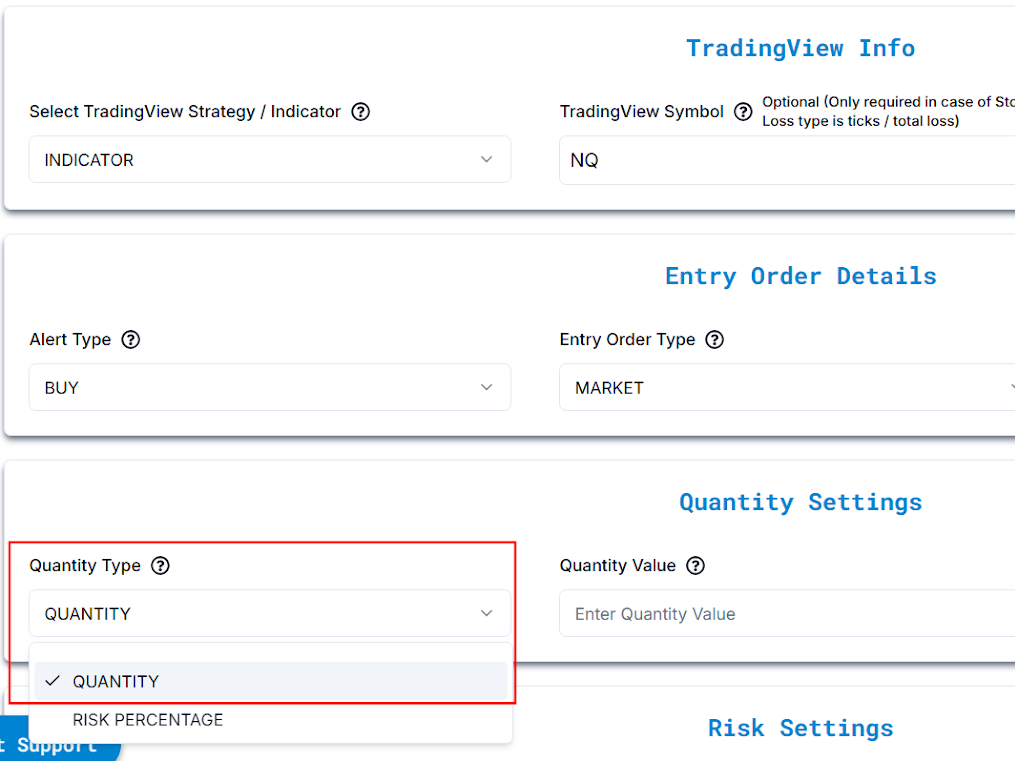

2. Selecting Your Trading Setup for Automation #

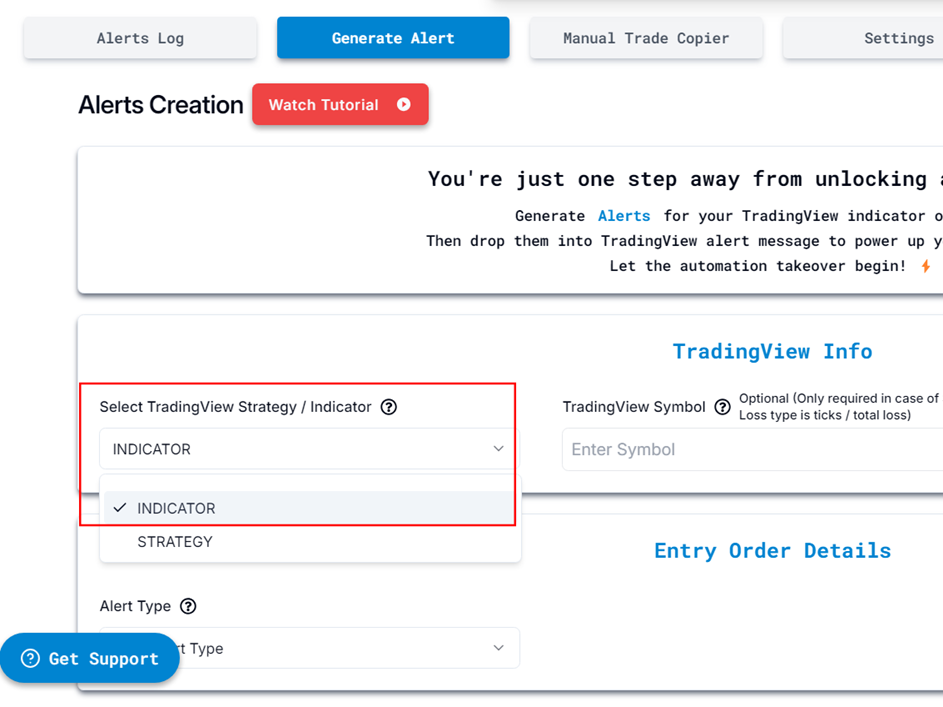

2.1 Choosing Your Trading Setup #

Before automation, decide whether you are using an Indicator-Based or Strategy-Based approach.

Indicator-Based Trading Setup

(Ideal for traders using RSI, Bollinger Bands, or other indicators to trigger trades.)

- Select Your Indicator: Choose a TradingView indicator to automate (e.g., RSI, Moving Averages).

3. Configuring PickMyTrade for Automated Trading #

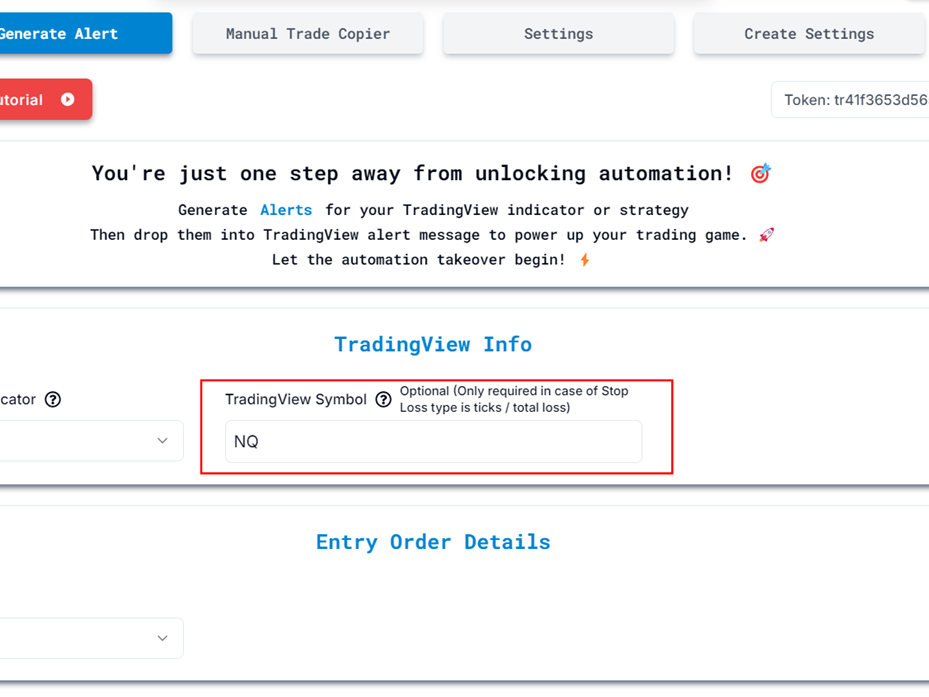

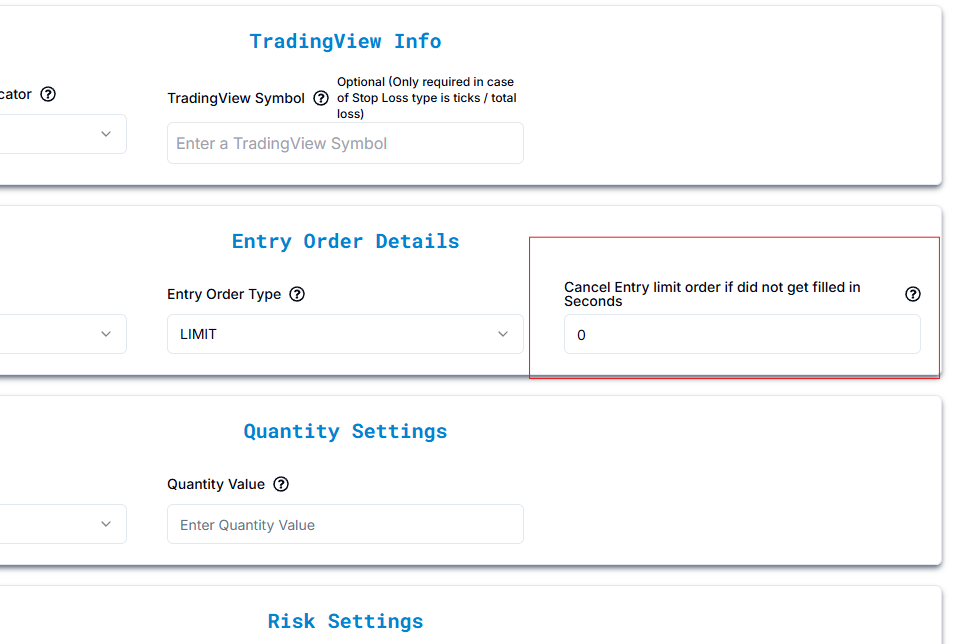

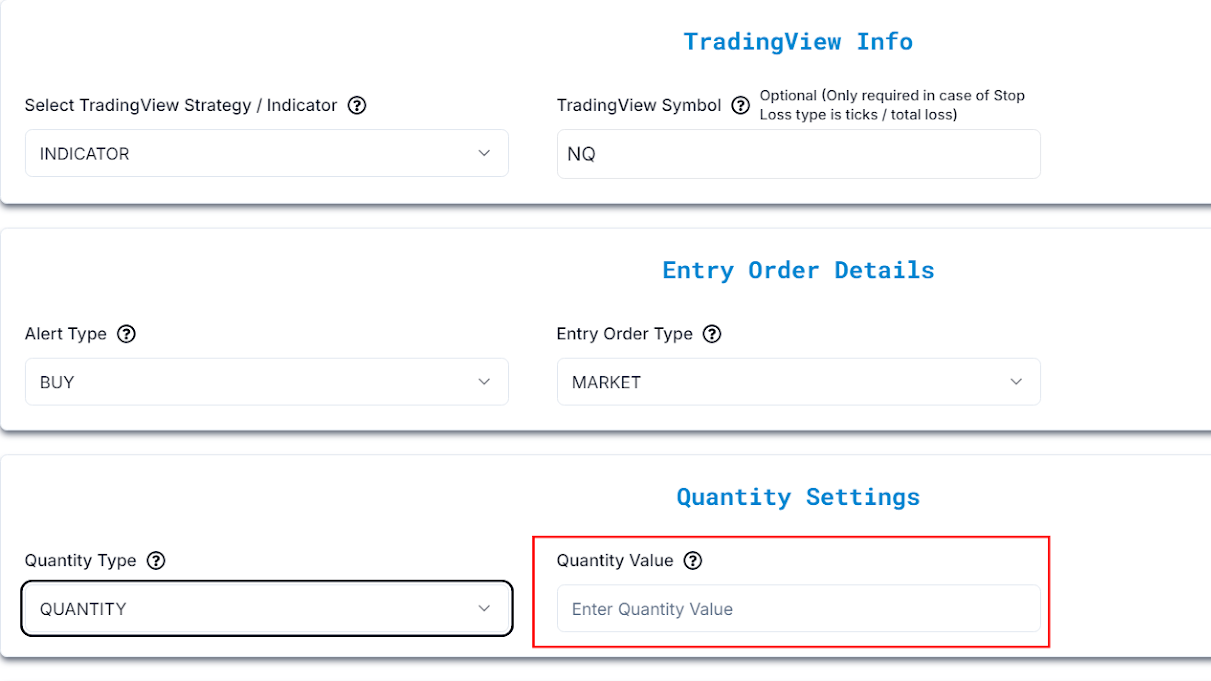

3.1 Enter Trading Symbol #

Specify the asset (symbol) to trade using PickMyTrade. This step is optional—but required if your stop loss/take profit needs to use tick size or dollar value logic.

If the symbol doesn’t exist or isn’t mapping correctly: You’ll need to set it up first in PickMyTrade. Only after that will trades happen on that symbol.

Want to send an alert from one symbol and trade another? You can! For example:

- You’re using NQ on your TradingView chart for the alert.

- But you want the actual trade to happen on MNQ.

- In this case, just enter MNQ in the PickMyTrade symbol field.

What if you don’t enter a symbol here? No worries — PickMyTrade will simply take the trade based on whatever chart you’ve set up in TradingView for the alert.

4. Alert Configuration for TradingView Indicators #

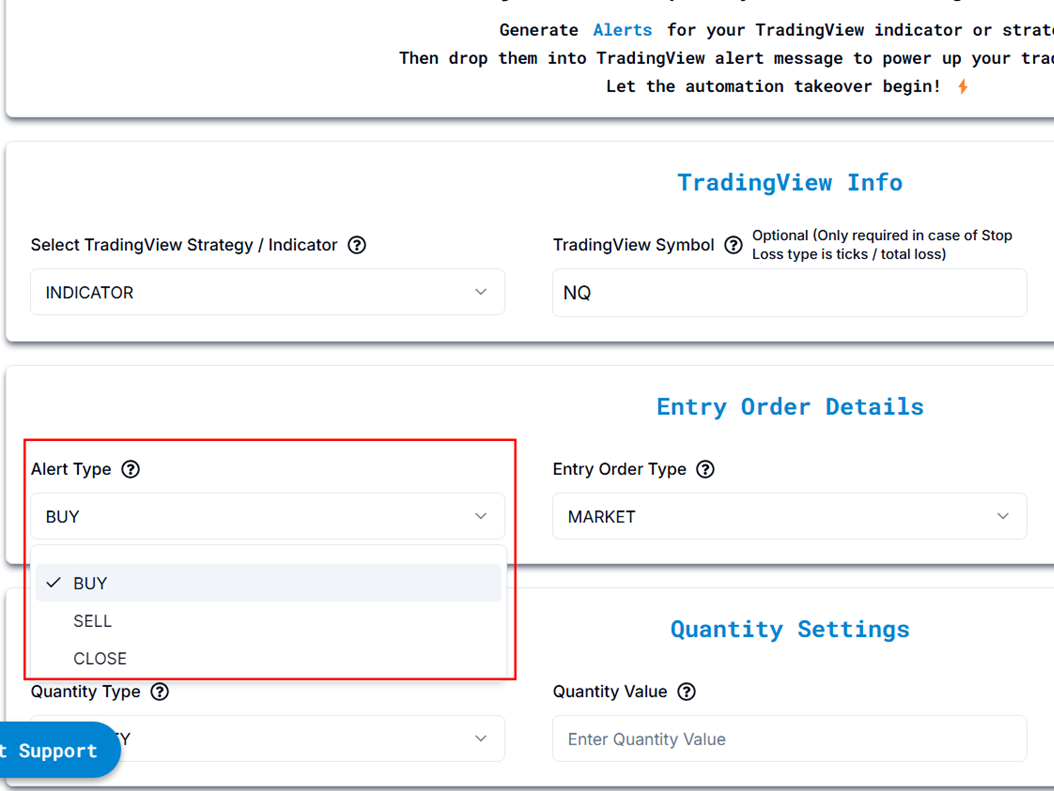

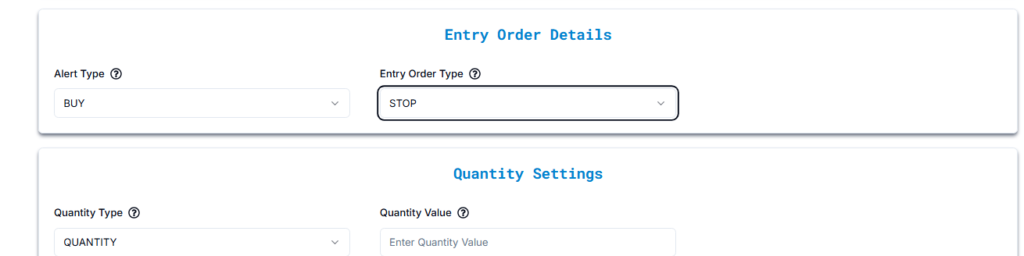

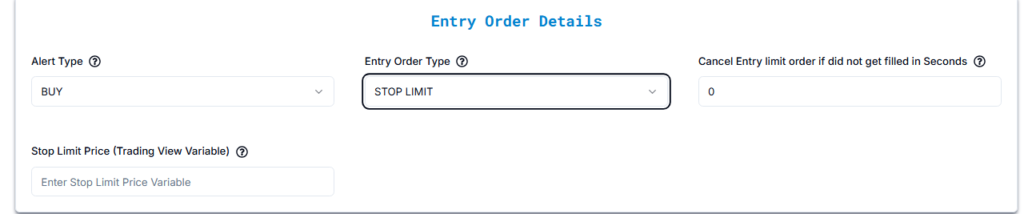

4.1 Select Alert Type #

Choose the type of trade action you want to automate:

- Buy Alert:

- Cancels any open positions and open orders.

- Opens a new buy position.

- Sell Alert:

- Cancels any open positions and open orders.

- Opens a new sell position.

- Close Alert:

- Closes all open positions and open orders.

- Does not open a new position.

5. Supported Order Types in PickMyTrade #

Trading automation depends on how you enter the market. Here’s how each order type works:

Order Type Comparison #

| Order Type | Best For | Execution | Risk |

|---|---|---|---|

| Market | Immediate entry | Guaranteed fill | Slippage possible |

| Limit | Precise price | May not fill | Missed trades |

| Stop | Breakout entries | Triggers at price | Gap risk |

| Stop Limit | Precise breakouts | May not fill | Combined risk |

#

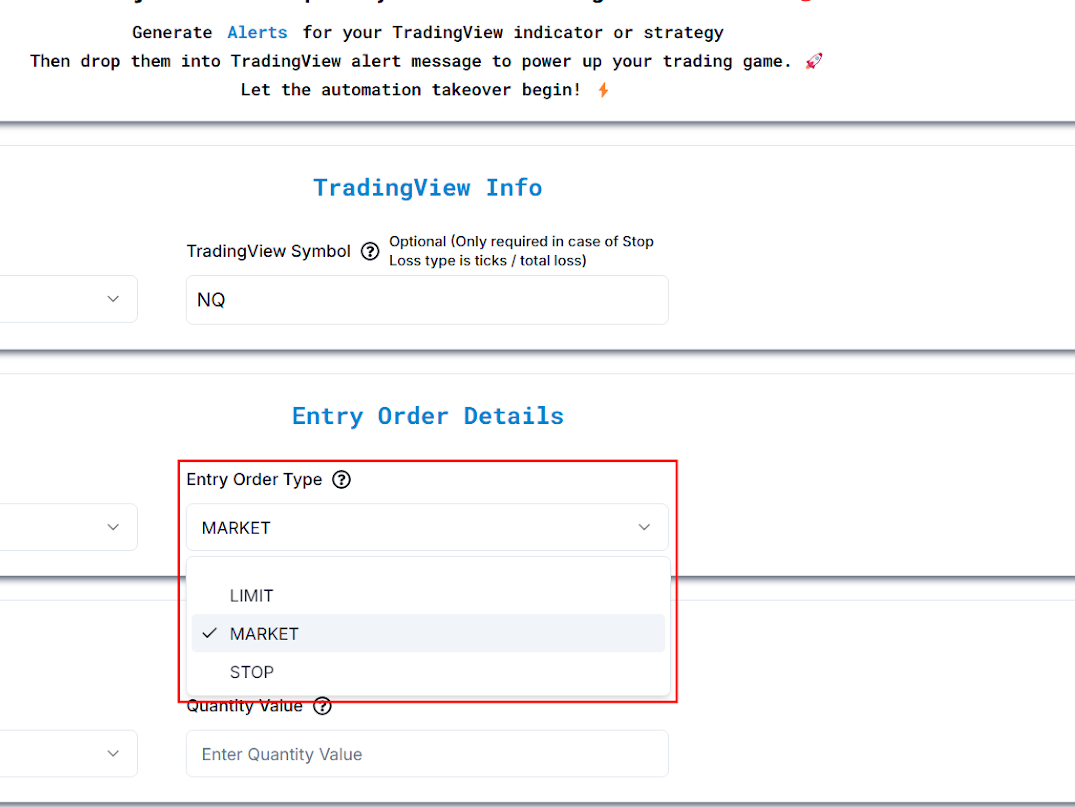

5.1 Choose Entry Order Type #

- Market Order:

- Definition: A market order is an order to buy or sell immediately at the current market price.

- Example: If NQ is at 21,891, and you place a market order to buy, it will execute immediately at or very close to 21,891. The order gets filled right away without waiting for any price changes.

- Limit Order:

- Definition: A limit order is an order to buy or sell only when the price reaches a specific level you set. If the price doesn’t reach that level, the order won’t be filled.

- Example: If you want to buy NQ at 21,850, you set a limit buy order. This order will not execute unless the price of NQ drops to 21,850. If the price stays above 21,850, your order won’t be filled.

- Note: We use TradingView’s

{{close}}placeholder to set the limit price.

- Stop Order (also called Stop Loss or Stop Entry):

- Definition: A stop order becomes a market order when the price reaches a specific trigger price. It’s often used for stop loss (to limit losses) or stop entry (to enter the market when a certain price is reached).

- Example: If NQ is at 21,891, and you place a buy stop order at 21,950, the order won’t execute until the price reaches 21,950. Once it does, the stop order becomes a market order and buys NQ at or near 21,950.

- Note: We use TradingView’s

{{close}}placeholder to set the stop price. If needed, you can replace it with any other available placeholder variable to suit your strategy. (Placeholder Explanation: Click here)

- Stop Limit Order:

- Definition: A stop limit order triggers a limit order when the stop price is reached. It gives you control over both the trigger price and the execution price.

- Example: If NQ is at 21,891, and you place a buy stop limit at 21,950, a limit order to buy is triggered once the price hits 21,950. The actual fill will only happen at 21,950 or better.

- Note: We use TradingView’s

{{close}}placeholder to set the stop limit price. If left blank, the system will automatically use the same value as the price field. This works even if bothstpandstplmtfields are blank. - Use Case: More control than a stop order; helps avoid slippage by specifying a max acceptable price.

- More Info: (Placeholder Explanation: Click here)

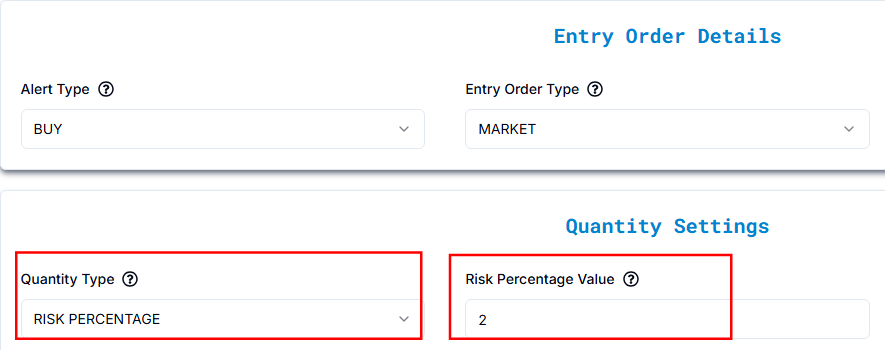

6. Setting Quantity and Position Sizing #

Choosing the right quantity type is essential for aligning your trade size with your risk management plan. PickMyTrade supports two main types:

- Fixed Quantity: You manually define how many contracts to trade.

Use this when you want full control over size and are not adjusting based on account balance or risk exposure.

- Risk Percentage: When using Risk Percentage, the system calculates your trade size so that your maximum loss equals a fixed percentage of your total account balance, based on the stop-loss distance.

- A stop-loss is required, because it defines how much you’re risking per trade.

Example:

If your account balance is $100,000 and you set a 2% risk, the system ensures your maximum possible loss is $2,000 on that trade.

6.1 Position Sizing Calculation for NQ Futures #

Position sizing is a critical part of risk management in futures trading. It ensures every trade aligns with your risk tolerance and helps preserve account capital over the long term. This section outlines the steps to calculate the proper position size when trading NQ (Nasdaq-100) futures.

6.1.1 Defining Account and Risk Parameters #

Before placing a trade, define your account size and the percentage of capital you’re willing to risk on a single trade:

| Parameter | Value |

|---|---|

| Account Balance | $10,000 |

| Risk Percentage Per Trade | 2% |

| Maximum Risk Amount | $250 |

Formula: Maximum Risk Amount = Account Balance × Risk Percentage

Example Calculation:

$10,000 × 2% = $250

The total allowable risk for this trade is $250.

6.1.2 NQ Contract Specifications #

Understanding contract specifications ensures accurate position sizing:

| Specification | NQ Contract Value |

|---|---|

| Point Value | $20 per point per contract |

| Minimum Tick Size | 0.25 points ($5) |

6.1.3 Trade Setup Example #

Let’s consider a hypothetical trade with the following parameters:

| Parameter | Value |

|---|---|

| Current NQ Price | 20,653.25 |

| Stop-Loss Distance | 10 points from the entry price |

| Take-Profit Target | 20 points from the entry price |

6.1.4 Risk Per Contract Calculation #

The dollar risk per contract is calculated by multiplying the stop-loss distance by the point value:

Risk Per Contract = Stop-Loss Distance × Point Value

Example Calculation:

10 points × $20 per point = $200

Hence, the risk per NQ contract is $200.

6.1.5 Position Size Calculation #

The number of contracts to trade is determined by dividing the maximum risk amount by the risk per contract:

Position Size = Maximum Risk Amount ÷ Risk Per Contract

Example Calculation:

$250 ÷ $200 = 1.25

Since futures contracts can’t be traded in fractional amounts, the position size is rounded down to 1 contract.

6.1.6 Additional Considerations #

- Lower Risk Percentages:

Reducing the risk percentage (e.g., to 1%) decreases the risk amount:

$10,000 × 1% = $100

With a $200 risk per contract, the calculated position size would be 0.5 contracts, which isn’t feasible. You’d either need to increase your risk percentage or account size to place the trade.

- Minimum Position Size:

If the calculated position size is less than one contract, the trade can’t be executed. Ensure your account size and risk settings allow at least one contract for NQ futures.

6.1.7 Conclusion #

Effective position sizing ensures you stay within your defined risk per trade. By factoring in account balance, stop-loss distance, and contract value, traders can maintain consistency and long-term capital preservation.

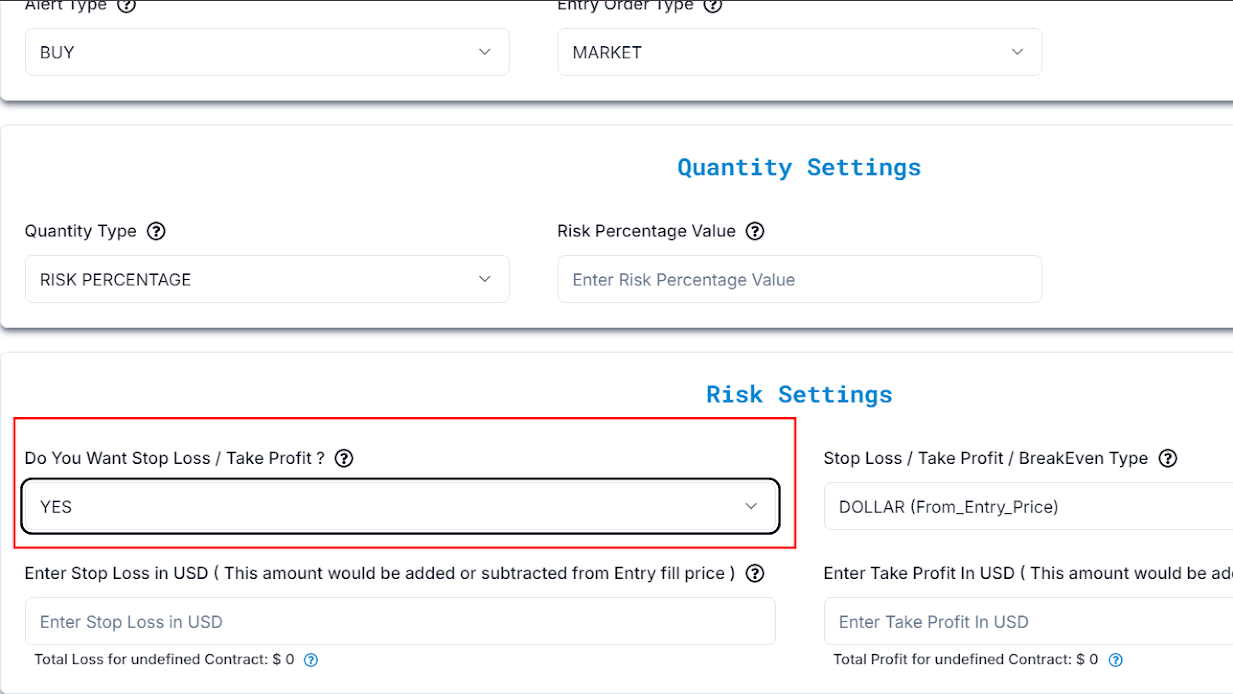

7. Stop Loss and Take Profit Settings in Automated Strategies #

Stop Loss and Take Profit orders are non-negotiable tools for disciplined trading. These exits help lock in gains and cut losses—without emotional interference.

7.1 Stop Loss #

A Stop Loss is a predefined price level at which a position is automatically closed if the market moves unfavorably. This helps limit potential losses by exiting the trade once the price reaches a specified point.

Example:

Suppose a trader buys NQ at 21,891. They set a Stop Loss at 21,841. If the market drops to 21,841, the position will automatically close, capping the loss at that point.

7.2 Take Profit #

A Take Profit is a predetermined price level at which a position is automatically closed when the market moves favorably. This order locks in profits once the price reaches the target set by the trader.

Example:

A trader buys NQ at 21,890 and sets a Take Profit at 21,991. When the market rises to 21,991, the position automatically closes, securing the profit.

Using Stop Loss and Take Profit orders helps traders manage both risk and reward effectively, ensuring a systematic approach to closing trades.

7.3 Enable Stop Loss & Take Profit #

Select Yes to activate risk management settings.

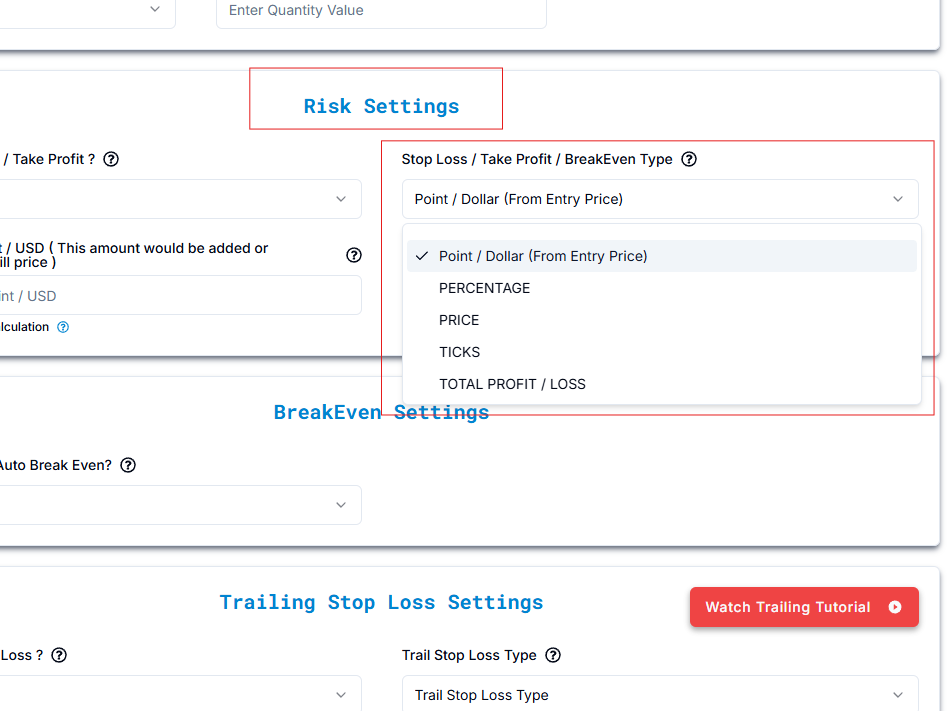

8. Risk Management Types for Automated Trading #

When setting stop loss (SL) and take profit (TP) orders, different methods can be used to determine the exit points of a trade. Each method offers a unique approach to managing risk and locking in profits, based on factors like price movement, percentage, or total value. Here’s a clear explanation of each type:

8.1 Dollar (from entry) #

This method sets the stop loss or take profit based on a fixed dollar amount from the entry price. It’s a straightforward way to manage trades in terms of actual monetary risk and reward.

Example: If a trader enters a position at $21,000 and sets a stop loss $500 below the entry price, the position will automatically close if the price falls to $20,500. Similarly, a take profit set $1,000 above the entry price would close the position at $22,000.

8.2 Percentage #

Here, the stop loss and take profit are calculated as a percentage of the entry price. This method keeps risk and reward proportional to the market price, making it useful for different price levels.

Example: If the entry price is $21,000 and the stop loss is set at a 2% decrease, the position will close if the price drops to $20,580. A take profit set at a 5% increase would close the position when the price reaches $22,050.

8.3 Price #

This method sets stop loss and take profit at specific price levels. These price levels are often chosen based on technical analysis, such as support and resistance zones.

Example: A trader entering a long position at $21,000 may set the stop loss at $20,800 (a support level) and the take profit at $22,200 (a resistance level).

8.4 Ticks #

A tick is the smallest possible price movement for a futures contract. Using this method, stop loss and take profit levels are set based on a specific number of ticks away from the entry price. This is especially useful in fast-moving markets.

Example: In NQ futures, one tick equals 0.25 points and is worth $5. A stop loss of 20 ticks would represent a $100 risk, while a take profit of 40 ticks would equal a $200 gain.

8.5 Total Profit/Loss #

This approach closes a position when a specific total profit or loss amount is reached, regardless of the price level. It’s often used when focusing on overall account balance or total monetary outcome.

Example: A trader might set a total loss limit of $500 and a total profit target of $1,000. Once either of these thresholds is met, the trade automatically closes — no matter where the market price is at that time.

Each of these methods offers flexibility in managing trades and helps you align your strategy with your risk tolerance and goals. Choosing the right approach depends on your trading style, market conditions, and how you prefer to manage risk and reward.

9. Detailed Breakdown: Stop Loss, Take Profit & BreakEven #

All the Stop Loss, Take Profit, and BreakEven types share the same TradingView symbol — NQ. This section covers different methods for managing trades and risk in detail.

9.1 Dollar (From Entry Price) #

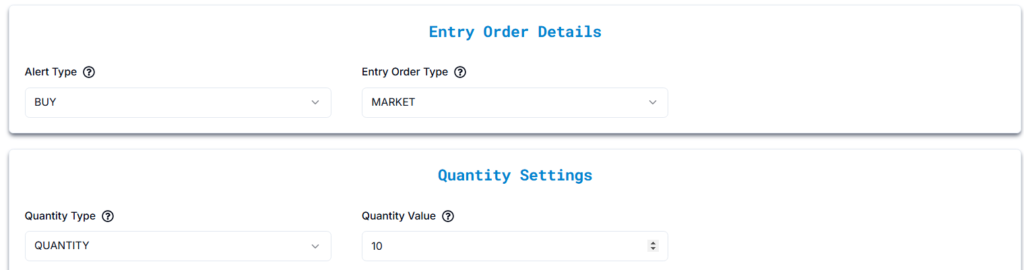

9.1.1 Entry Order Details #

- Alert Type: BUY — This means you’re placing an order to purchase.

- Entry Order Type: MARKET — Buys contracts at the current market price.

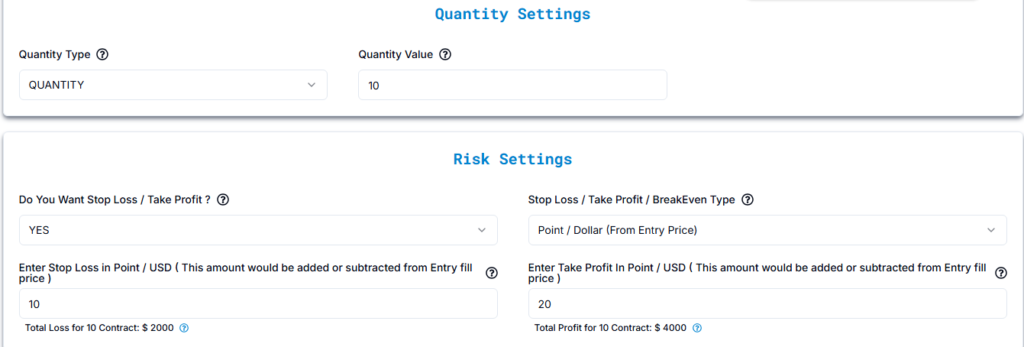

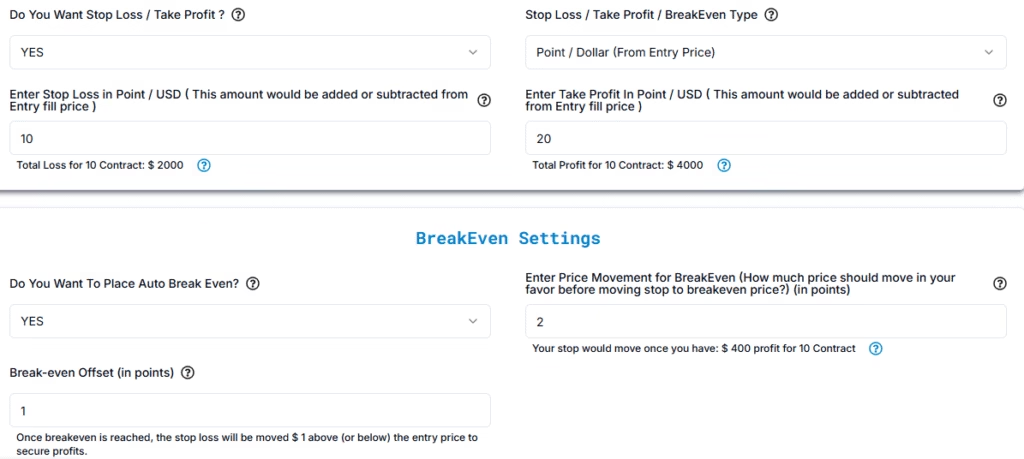

9.1.2 Quantity Settings #

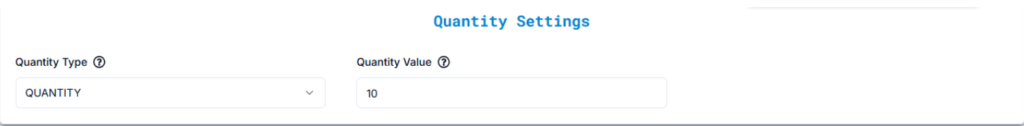

- Quantity Type: QUANTITY — Specifies the number of contracts directly.

- Quantity Value: 10 — You’re buying 10 contracts in this trade.

9.1.3 Risk Settings #

- Stop Loss / Take Profit Type: Point / Dollar (From Entry Price)

9.1.4 Stop Loss & Take Profit Calculation for 10 Contracts #

- Stop Loss: 10 Points → $2,000 total loss for 10 contracts

- Take Profit: 20 Points → $4,000 total profit for 10 contracts

9.1.5 Example #

- Buy NQ at 21,891

- Stop Loss: 10 Points below entry → New stop loss at 21,791

- Take Profit: 20 Points above entry → New take profit at 22,091

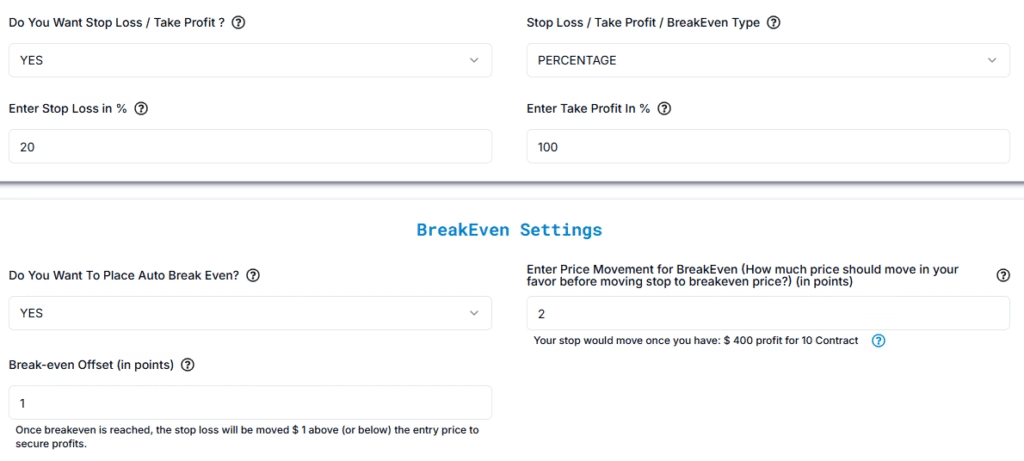

9.1.6 BreakEven Settings #

- BreakEven activates after a 2-Point price movement in favor

- BreakEven triggers at 21,893 (after a 2-Point move = $400 total profit for 10 contracts)

- Once triggered, the stop loss moves to the entry price (21,891) plus a BreakEven Offset of 1 Point, moving the new stop loss to 21,892 — locking in a $200 total profit (for 10 contracts).

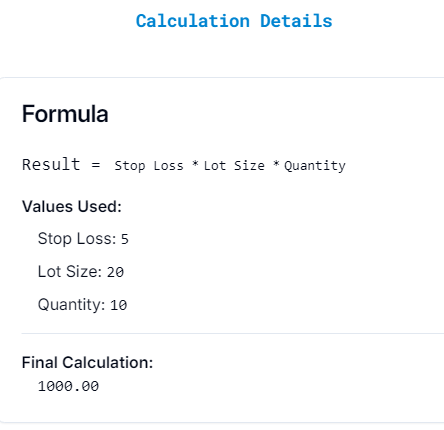

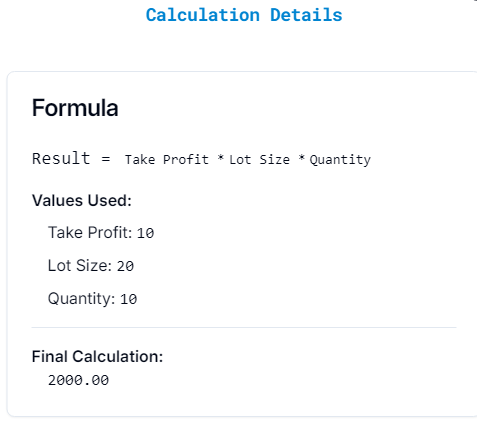

9.1.7 Calculation Details #

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula used

- The Values Entered by the user

- The Final Calculation result

Stop Loss in USD:

- Formula: Result = Stop Loss USD * Lot Size * Quantity

- Example Calculation: (Same numbers for illustration) 5 * 20 * 10 = 1000.00 USD

Take Profit in USD:

- Formula: Result = Take Profit USD * Lot Size * Quantity

- Example Calculation: 10 * 20 * 10 = 2000.00 USD

9.2 Percentage #

9.2.1 Entry Order Details #

- Alert Type: BUY — This means you’re placing an order to purchase

- Entry Order Type: MARKET— This type of order buys the contracts at the current market price right away

9.2.2 Quantity Settings #

- Quantity Type: QUANTITY — You’re specifying the number of contracts directly

- Quantity Value: 10 — This means you’re buying 10 contracts in this trade

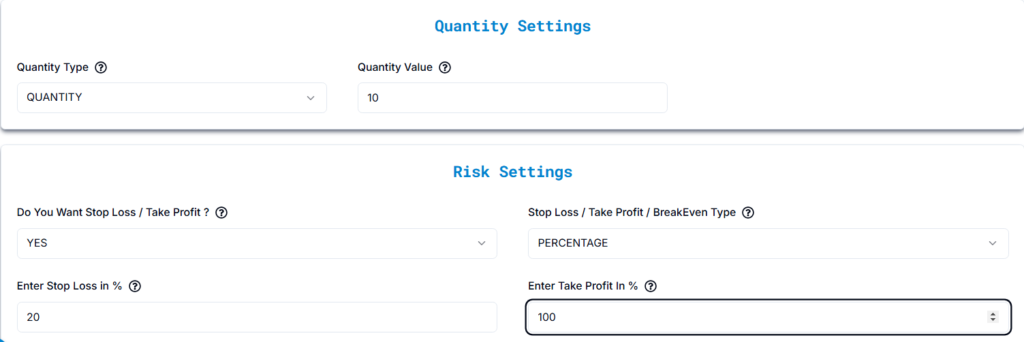

9.2.3 Risk Settings #

- Stop Loss / Take Profit Type: PERCENTAGE

9.2.4 Stop Loss & Take Profit Calculation (Percentage-Based) #

- Stop Loss: 20% of 21,891 = 4,378.20

- Stop Loss Price = 17,512.80

- Take Profit: 100% of 21,891 = 21,891

- Take Profit Price = 43,782

9.2.5 BreakEven Settings #

BreakEven activates after a 2-Point price movement in favor

- Buy NQ at 21,891

- BreakEven triggers at 21,893 (after a 2-Point move = $400 total profit for 10 contracts)

- Once triggered, the stop loss moves to the entry price (21,891) plus a BreakEven Offset of 1 Point, creating a new stop loss at 21,892 — locking in a $200 total profit for 10 contracts instead of just breaking even.

9.3 Price #

9.3.1 Entry Order Details #

- Alert Type: BUY — This means you’re placing an order to purchase.

- Entry Order Type: MARKET — This type of order buys the contracts at the current market price right away.

9.3.2 Quantity Settings #

- Quantity Type: QUANTITY — You’re specifying the number of contracts directly.

- Quantity Value: 10 — This means you’re buying 10 contracts in this trade.

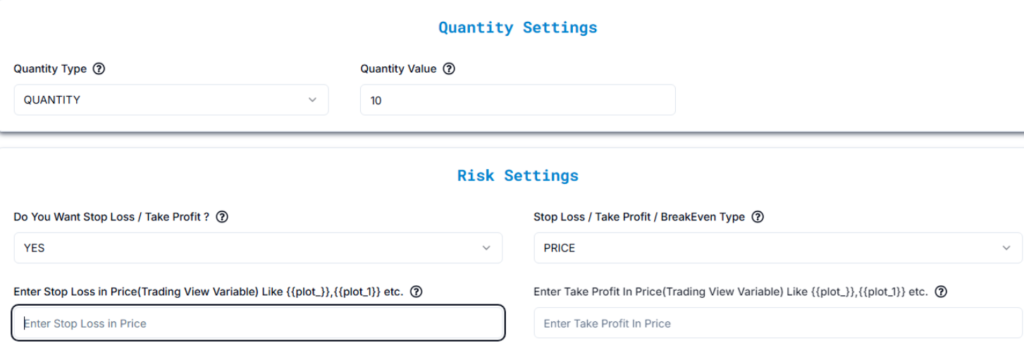

9.3.3 Risk Settings #

- Stop Loss / Take Profit: YES

- Stop Loss / Take Profit / BreakEven Type: PRICE

9.3.4 Stop Loss & Take Profit #

Stop Loss (Auto-Filled Price):

Enter the stop loss price from your TradingView indicator. Use TradingView variables like {{plot_1}}, {{plot_2}}, etc.

Example: If Stop Loss is 21,691, enter {{plot_1}} when creating the alert.

Take Profit (Auto-Filled Price):

Enter the take profit price from your TradingView indicator. Use TradingView variables like {{plot_1}}, {{plot_2}}, etc.

Example: If Take Profit is 22,091, enter {{plot_2}} when creating the alert.

9.3.5 Understanding {{plot_x}} Variables in TradingView #

In TradingView, {{plot_0}}, {{plot_1}}, {{plot_2}}, etc., are placeholders that TradingView provides when you create an alert based on an indicator. These placeholders represent the different output values that the indicator shows on the chart.

{{plot_0}}— The first value plotted by the indicator.{{plot_1}}— The second value plotted by the indicator.{{plot_2}}— The third value, and so on.

How They Work for Stop Loss & Take Profit

Let’s say your indicator plots two important levels:

- Stop Loss level

- Take Profit level

In this case:

- Stop Loss will be assigned to a variable like

{{plot_1}} - Take Profit will be assigned to a variable like

{{plot_2}}

When setting an alert, you don’t have to enter fixed numbers (like 21,691) manually. Instead, you just select these placeholders:

{{plot_1}}for Stop Loss{{plot_2}}for Take Profit

Example Alert Setup in TradingView

When creating an alert, enter this in the message box:

Loss: {{plot_1}}, Take Profit: {{plot_2}}

Example Scenario

At the time of alert creation:

{{plot_1}}= 21,691 (Stop Loss){{plot_2}}= 22,091 (Take Profit)

When the alert triggers, you will receive this message:

Stop Loss: 21,691, Take Profit: 22,091

Important Note

The second plot becomes {{plot_1}}, the third {{plot_2}}, and so on — following the order in which they appear in the indicator’s code or settings.

The first plot you add in your indicator will always be accessible as {{plot_0}}.

9.3.6 Trail Stoploss Settings #

PickMyTrade calculates the point distance between the alert’s entry price and the provided SL/TP values. These distances are then applied dynamically from the actual fill price.

This approach ensures accurate trailing stop behavior even if the fill price differs from the alert price.

For details, refer to: Trailing Stop Loss Using Price Values from TradingView – PickMyTrade

9.4 Ticks #

9.4.1 Entry Order Details #

- Alert Type: BUY — This means you’re placing an order to purchase.

- Entry Order Type: MARKET — This type of order buys the contracts at the current market price right away.

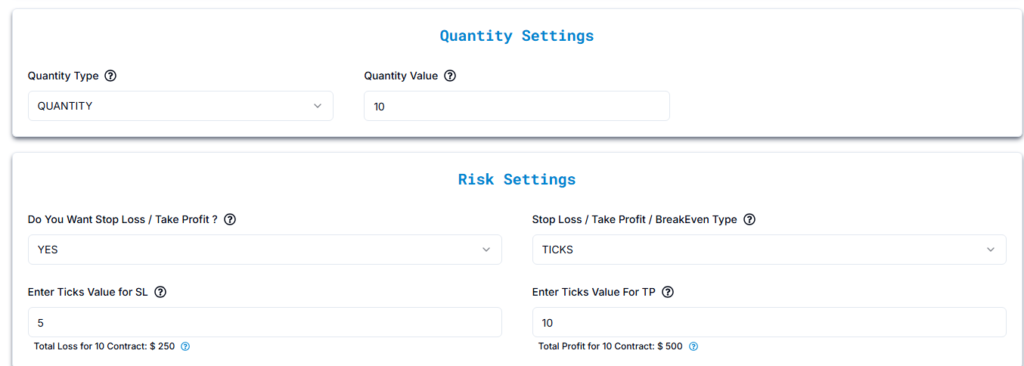

9.4.2 Quantity Settings #

- Quantity Type: QUANTITY — You’re specifying the number of contracts directly.

- Quantity Value: 10 — This means you’re buying 10 contracts in this trade.

9.4.3 Risk Settings #

9.4.3.1 Stop Loss (SL) Calculation #

- Stop Loss Type: TICKS

- Stop Loss Value: 5 ticks below entry

Example Calculation:

- Entry Price: 21,891

- Tick Size: 0.25 points per tick (For NQ futures)

- 5 Ticks Movement: 5 × 0.25 = 1.25 points

- Stop Loss Price: 21,891 – 1.25 = 21,889.75

Loss Calculation:

- Each Tick Value: $5 per contract

- Total Contracts: 10

- Total Loss per Tick: 10 × $5 = $50

- Total Loss for 5 Ticks: 5 × $50 = $250

So if the price hits 21,889.75, the total loss is $250 for 10 contracts.

9.4.3.2 Take Profit (TP) Calculation #

- Take Profit Type: TICKS

- Take Profit Value: 10 ticks above entry

Example Calculation:

- Entry Price: 21,891

- Tick Size: 0.25 points per tick

- 10 Ticks Movement: 10 × 0.25 = 2.5 points

- Take Profit Price: 21,891 + 2.5 = 21,893.5

Profit Calculation:

- Total Profit per Tick: $50 (10 contracts × $5 per tick)

- Total Profit for 10 Ticks: 10 × $50 = $500

So if the price hits 21,893.5, the total profit is $500 for 10 contracts.

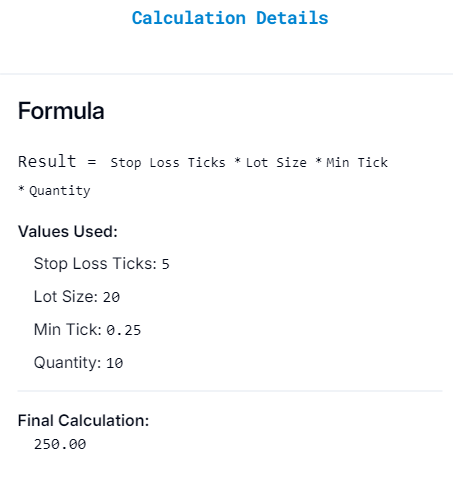

9.4.4 Calculation Details #

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula Used

- The Values Entered by the User

- The Final Calculation Result

Stop Loss Calculation:

- Formula: Result = Stop Loss Ticks × Lot Size × Min Tick × Quantity

- Example Calculation: 5 × 20 × 0.25 × 10 = $250.00

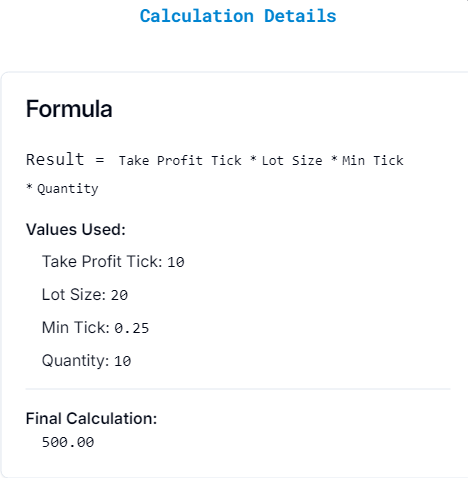

Take Profit Calculation:

- Formula: Result = Take Profit Ticks × Lot Size × Min Tick × Quantity

- Example Calculation: 10 × 20 × 0.25 × 10 = $500.00

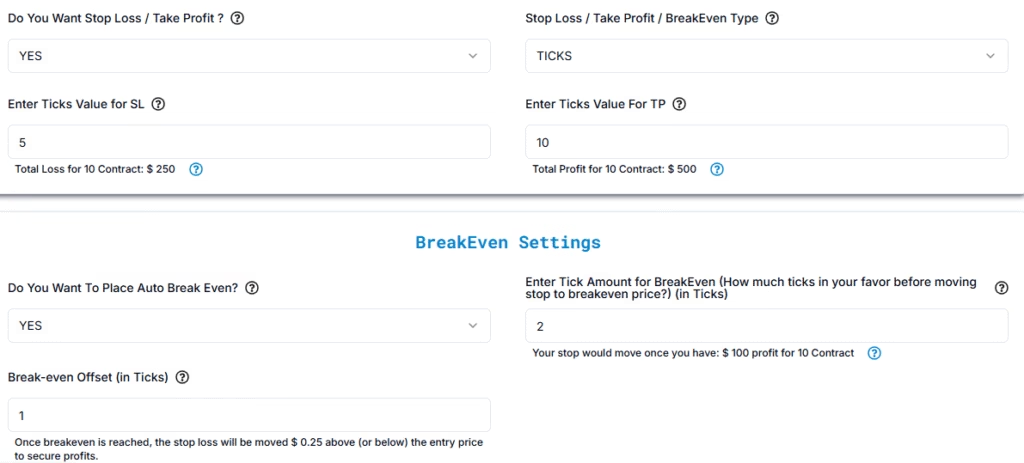

9.4.5 BreakEven Settings #

9.4.5.1 BreakEven Activation Calculation #

- BreakEven Triggers After: 2 ticks in profit

- BreakEven Stop Loss Adjustment: Moves stop loss to entry price (21,891) plus a BreakEven Offset of 1 tick

Example Calculation:

- Entry Price: 21,891

- Tick Size: 0.25 points per tick

- BreakEven Activation Price: 21,891.5 (after a 2-tick move)

- BreakEven Offset: 1 tick = 0.25 points

Profit at 2 Ticks:

- 2 ticks × $5 per contract = $10 per contract

- For 10 contracts = $100 total profit

New Stop Loss Price After Activation:

- 21,891 (entry) + 0.25 (1-tick offset) = 21,891.25

So once the price reaches 21,891.5, the stop loss automatically moves to 21,891.25, locking in a $125 total profit (10 contracts × $1.25 per tick equivalent), instead of just breaking even.

9.5 Total Profit / Loss #

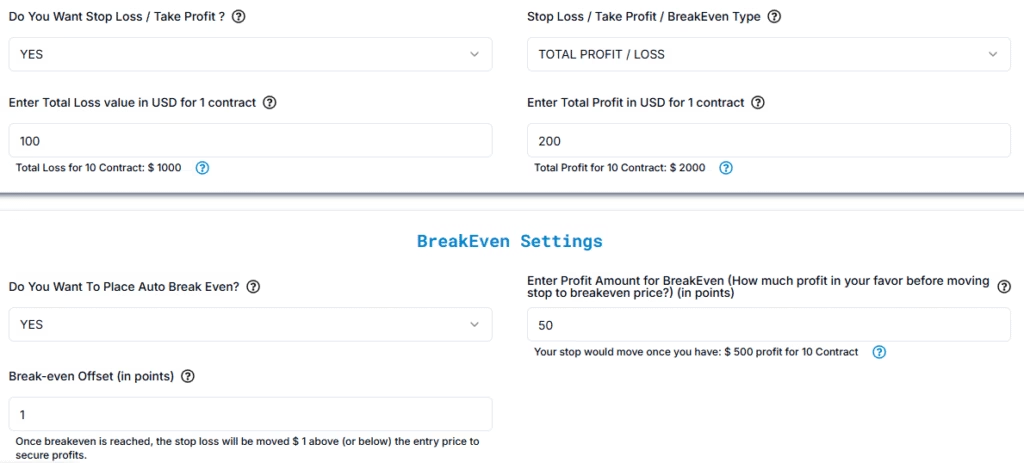

9.5.1 Entry Order Details #

- Alert Type: BUY — This means you’re placing an order to purchase.

- Entry Order Type: MARKET — This type of order buys the contracts at the current market price right away.

9.5.2 Quantity Settings #

- Quantity Type: QUANTITY — You’re specifying the number of contracts directly.

- Quantity Value: 10 — This means you’re buying 10 contracts in this trade.

9.5.3 Risk Settings #

9.5.3.1 Stop Loss Calculation #

- Stop Loss / Take Profit Type: TOTAL PROFIT / LOSS

- Stop Loss: $100 per contract

Example:

- Buy NQ at: 21,891

- Total Loss for 10 Contracts: $100 × 10 = $1,000

Stop Loss Price Calculation:

- 1 Point Value: $20 per contract

- Points to Stop Loss: $100 ÷ $20 = 5 points

- Stop Loss Price: 21,891 – 5 points = 21,886

9.5.3.2 Take Profit Calculation #

- Take Profit: $200 per contract

Example:

- Buy NQ at: 21,891

- Total Profit for 10 Contracts: $200 × 10 = $2,000

Take Profit Price Calculation:

- 1 Point Value: $20 per contract

- Points to Take Profit: $200 ÷ $20 = 10 points

- Take Profit Price: 21,891 + 10 points = 21,901

9.5.4 BreakEven Settings #

BreakEven Activation Price Calculation:

- Buy NQ at: 21,891

- 1 Point Value: $20 per contract

- Points to BreakEven Activation: $50 ÷ $20 = 2.5 points

- BreakEven Activation Price: 21,891 + 2.5 points = 21,893.5

- Breakeven Offset: 1 Point

Total Profit to Trigger BreakEven:

- Profit per Contract: $50

- Total Contracts: 10

- Total Profit: $50 × 10 = $500

Stop Loss Adjustment:

Once the price reaches 21,893.5, the stop loss moves to the entry price (21,891) plus a BreakEven Offset of 1 point, creating a new stop loss at 21,892.

This locks in a $200 total profit (10 contracts × $20 per point), instead of just breaking even, providing a small profit cushion in case the market reverses.

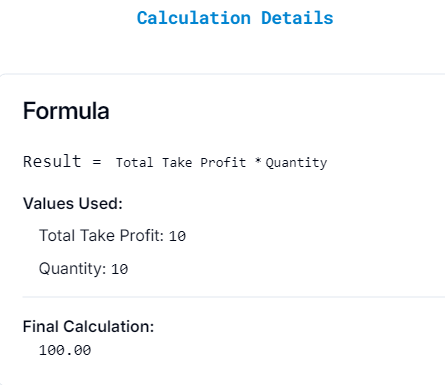

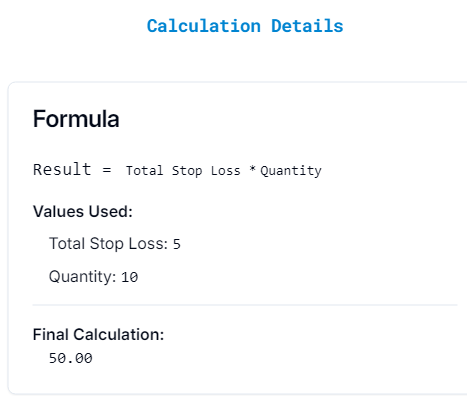

9.5.5 Calculation Details #

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula Used

- The Values Entered by the User

- The Final Calculation Result

Total Profit in USD Calculation:

- Formula: Total Profit (USD) = Total Take Profit × Lot Size × Quantity

- Values Used:

- Total Take Profit: 10

- Quantity: 10

- Final Calculation: 10 × 10 = $100.00

Total Loss in USD Calculation:

- Formula: Total Loss (USD) = Total Stop Loss × Lot Size × Quantity

- Values Used:

- Total Stop Loss: 5

- Quantity: 10

- Final Calculation: 5 × 10 = $50.00

10. Trailing Stop Loss Settings for Automated Trading #

(Common for Dollar (From Entry Price), Percentage, Ticks, Total Profit/Loss)

10.1 Symbol and Quantity #

- Symbol: NQ

- Quantity: 10 Contracts

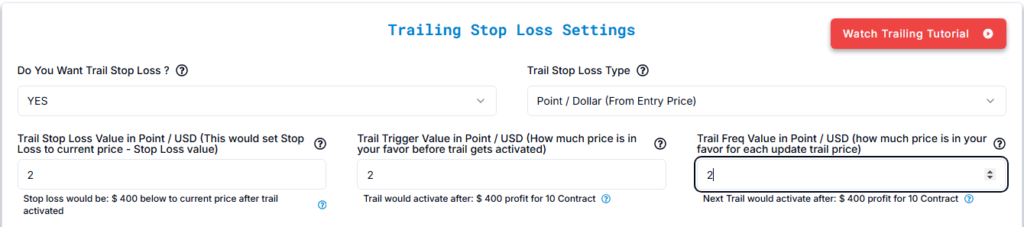

10.2 Trailing Stop Loss in Point / Dollar (From Entry Price) #

10.2.1 Trail Stop Loss Configuration #

- Do You Want Trail Stop Loss?:

- Option: YES / NO

- Purpose: Enables or disables the trailing stop loss feature.

- Trail Stop Loss Type:

- Type: Point / Dollar (From Entry Price)

- Trail Stop Loss Value:

- Value: Points / USD below the current price after the trailing stop activates

Example:

- Current Price: 100

- Trail Stop Loss Value: 20 points

- Once activated, the stop loss will always stay 20 points below the current price.

- Trail Trigger Value:

- Value: How much the price must move in your favor before the trailing stop activates

Example:

- Trail Trigger Value: 5 points

- Price must reach 105 (100 + 5 points) for the trailing stop to activate.

- Trail Frequency Value:

- Value: How much the price must move in your favor for each trailing stop update

Example:

- Trail Frequency Value: 2 points

- Once the trailing stop activates at 105:

- At 105: Stop loss sets to 105 – 20 = 85

- At 107: Price moves up 2 points → Stop loss adjusts to 107 – 20 = 87

- At 109: Another 2-point move → Stop loss updates to 109 – 20 = 89

- If the price reverses and hits 89, the position closes and locks in the profit/loss.

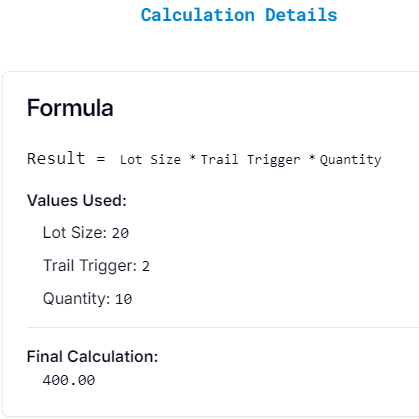

10.3 Calculation Details for Point / Dollar #

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula Used

- The Values Entered by the User

- The Final Calculation Result

Trail Trigger in USD Calculation:

- Formula: Result = Trail Trigger USD × Lot Size × Quantity

- Example Calculation: 2 × 20 × 10 = $400.00

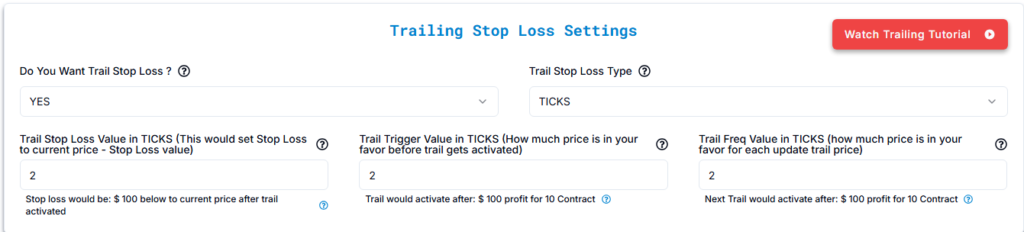

10.4 Trailing Stop Loss in Ticks #

10.4.1 Trail Stop Loss Configuration #

- Do You Want Trail Stop Loss?:

- Option: YES / NO

- Purpose: Enables or disables the trailing stop loss feature.

- Trail Stop Loss Type:

- Type: TICKS

- Trail Stop Loss Value:

- Value: Number of ticks below the current price after the trailing stop activates

Example:

- 1 Tick Value: $10 per contract

- Trail Stop Loss Value: 8 ticks

- Once activated, the stop loss will always stay 8 ticks below the current price.

- Total Loss for 10 Contracts: 8 ticks × $10 × 10 = $800 total loss

- Trail Trigger Value:

- Value: How much the price must move in your favor (in ticks) before the trailing stop activates

Example:

- Trail Trigger Value: 10 ticks

- The trailing stop will only activate when the price moves 10 ticks in your favor.

- Total Profit for 10 Contracts: 10 ticks × $10 × 10 = $1,000 total profit

- Trail Frequency Value:

- Value: How often the stop loss updates in ticks (i.e., how much price must move in your favor for each trailing stop adjustment)

Example:

- Trail Frequency Value: 2 ticks

- Once the trailing stop activates:

- At 10 ticks in profit: Stop loss sets to Current Price – 8 ticks

- At 12 ticks in profit: Price moves up 2 ticks → Stop loss adjusts by 2 ticks

- At 14 ticks in profit: Another 2-tick move → Stop loss updates again

- If the price reverses and hits the adjusted stop loss → The position closes, locking in the profit or loss

- Example Profit: 2 Ticks = $100 total profit for 10 contracts

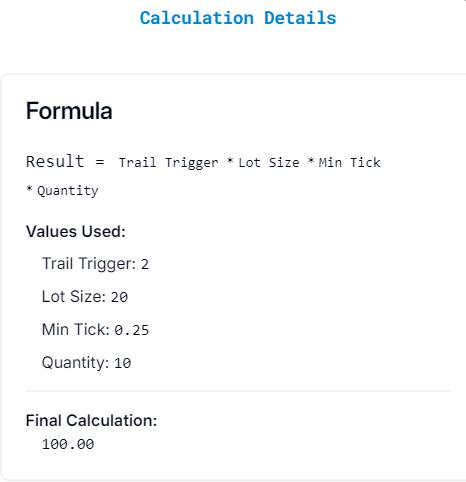

10.5 Calculation Details for Ticks #

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula Used

- The Values Entered by the User

- The Final Calculation Result

Trail Trigger Calculation:

- Formula: Result = Trail Trigger × Lot Size × Min Tick × Quantity

- Example Calculation: 2 × 20 × 0.25 × 10 = $400.00

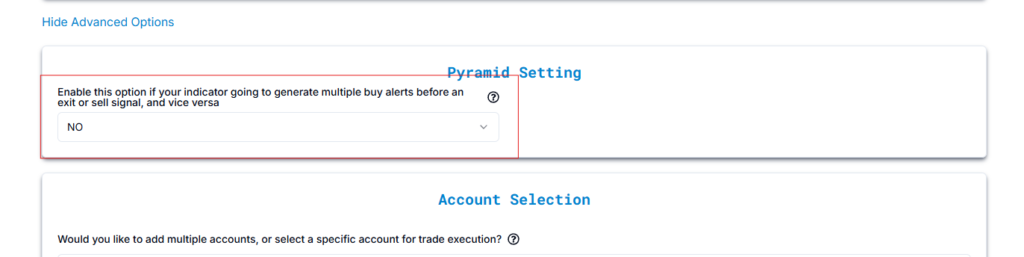

Pyramid Mode for Multi-Position Management #

By default, Pyramid Mode is False, meaning: #

- If a buy alert comes and there is already an open buy/sell position, it will cancel the existing position before opening a new one.

- If a sell alert comes and there is already an open buy/selll position, it will cancel the existing position before opening a new one.

If Pyramid Mode is True: #

- Buy alerts will not cancel existing buy positions.

- Sell alerts will not cancel existing sell positions.

- Allows stacking positions in the same direction.

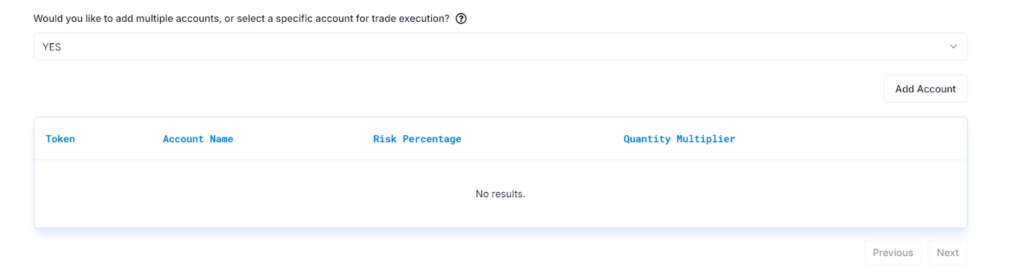

11. Account Selection and Multi-Account Trading #

11.1 Enable Multi-Account Trading: Select Yes if you want to execute trades across multiple accounts. #

11.2 Add Multiple Accounts for Trade Execution #

| Setting | Explanation | Example |

|---|---|---|

| Add Account | Select Yes if you want to add multiple accounts for trade execution. This allows you to execute trades across different accounts. | Example: If you have two Apex accounts (e.g., Apex_123456 and Apex_789012), you can add them here to execute trades on both accounts simultaneously. |

| Token | Enter the PickMyTrade Token for the account. This is a unique identifier required for integration with PickMyTrade. | Example: The token could be a unique string such as 41f3653d565f1aadbe8y for your first account and 41f3653d565f1aadbe8g for your second account. |

| Account Name | Enter the account name exactly as it appears in your trading platform (e.g., Apex account names). | Example: You can name your accounts Apex_123456 for your primary account and Apex_789012 for your secondary account. |

| Risk Percentage | Enter the Risk Percentage for the account. This sets the percentage of your capital to risk for each trade on this account. | Example: Setting a risk percentage of 2% for Apex_123456 and 1.5% for Apex_789012 means that each trade will risk 2% of your total capital in the first account and 1.5% in the second account. |

| Quantity Multiplier | Enter the Quantity Multiplier. This value allows you to adjust the number of contracts based on the account’s configuration. | Example: If your multiplier is 1.5 for Apex_123456 and 1.0 for Apex_789012, then your first account will trade 1.5 times the default contract size, while the second will trade the standard amount. |

Quick Decision Guide: Which Settings Should I Use? #

Are you new to automated trading? #

→ Yes:

Start with:

- Market orders

- Fixed quantity

- Single TP & SL

Do you want automatic position sizing? #

→ Yes: Use Risk Percentage

→ No: Use Fixed Quantity

Do you want to scale out of trades? #

→ Yes: Enable Multiple Take Profits (TP1, TP2)

→ No: Use Single TP

Best Practices #

- Always test in Sim first

- Start with one indicator

- Avoid overlapping alerts

- Use realistic stop losses

- Monitor execution logs early