1. Introduction #

Knowing how to place trades in multiple accounts is essential for traders managing multiple strategies or portfolios. With PickMyTrade, you can execute trades across multiple Tradovate accounts whether they are subaccounts under a single login or separate credentials using one TradingView alert.

This guide explains how to configure multiple account settings, add Tradovate accounts, and set up trade execution parameters, including quantity multipliers and risk percentages. Each setting is explained step by step to ensure precise trade execution across all linked accounts.

2. Configuring Multiple Accounts for Trade Execution #

2.1 Add Account Settings #

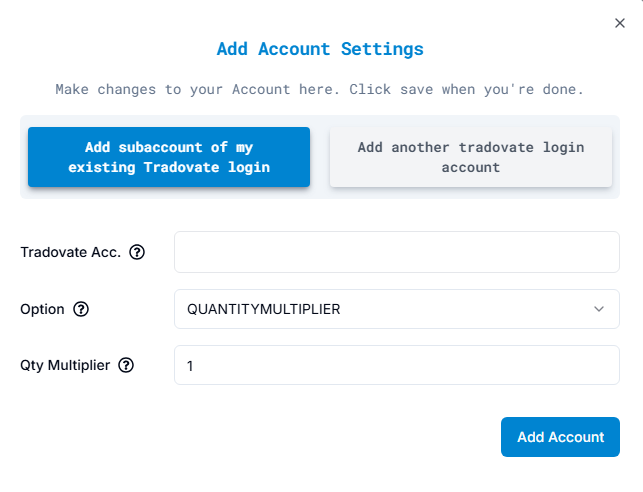

This section allows you to configure additional accounts for executing trades. You can link sub-accounts under your existing Tradovate login or add a completely separate Tradovate account.

A. Add a Subaccount Under an Existing Tradovate Login #

If you already have multiple subaccounts under your existing Tradovate login, you can allocate trades to them using quantity multipliers or risk percentages.

- Tradovate Account Selection: Choose the subaccount where you want to execute trades.

- Trade Allocation Method: Select either Quantity Multiplier or Risk Percentage from the dropdown menu.

- Quantity Multiplier: Adjusts the number of contracts proportionally for each account.

- Risk Percentage: Allocates a percentage of your capital to the trade, automatically calculating the contract size based on stop loss and account balance.

- Quantity Multiplier: Enter a multiplier value to scale contract size based on your primary strategy.

Example: #

If you have two subaccounts:

- Apex_123456 (Primary) → Multiplier: 1.5 (Executes 1.5 times the default contract size)

- Apex_789012 (Secondary) → Multiplier: 1.0 (Executes the standard contract size)

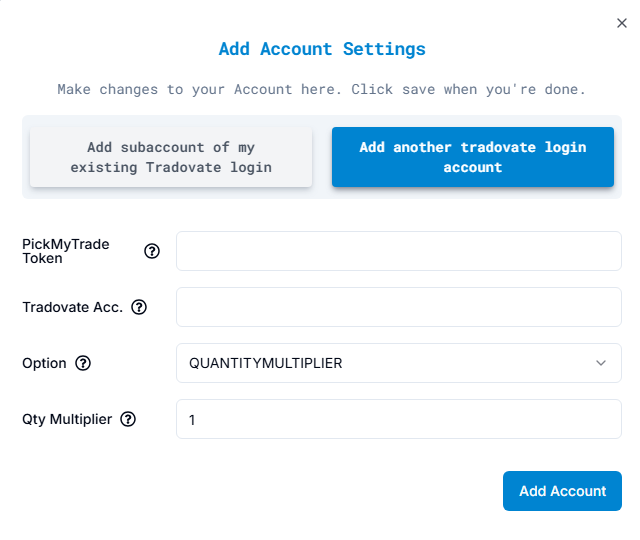

B. Add a Separate Tradovate Login Account #

For users who operate multiple Tradovate accounts under different logins, PickMyTrade allows linking them by entering a unique authentication token.

- PickMyTrade Token: Enter the token associated with the Tradovate account you wish to add. This ensures secure order execution.

- Tradovate Account Selection: Enter the exact account name as displayed in your trading platform.

- Trade Allocation Method: Choose either Quantity Multiplier or Risk Percentage.

- Quantity Multiplier: Defines how much the contract size should be adjusted for this account.

Example: #

If you have two separate Tradovate logins with different strategies:

- Apex_654321 (Second Tradovate Account) → Risk Percentage: 2%

- Apex_789012 (Primary Tradovate Account) → Risk Percentage: 1.5%

In this scenario, each trade risks 2% of total capital in the second account and 1.5% in the primary account, ensuring proportional exposure across both.

3. Example JSON Alert for Multiple Accounts #

Once accounts are configured, the following JSON alert structure enables trade execution across multiple accounts:

{

"symbol": "NQ",

"date": "{{timenow}}",

"data": "buy",

"quantity": 0,

"risk_percentage": 2,

"price": "{{close}}",

"tp": 0,

"percentage_tp": 0,

"dollar_tp": 10,

"sl": 0,

"percentage_sl": 0,

"dollar_sl": 5,

"token": "your_token_here",

"multiple_accounts": [

{

"token": "your_token_here",

"account_id": "Apex_123456",

"risk_percentage": 2,

"quantity_multiplier": 1.5

},

{

"token": "your_token_here",

"account_id": "Apex_789012",

"risk_percentage": 1.5,

"quantity_multiplier": 1.0

}

]

}4. Key Takeaways #

- Subaccounts can be added under an existing Tradovate login with either quantity multipliers or risk-based trade allocation.

- Separate Tradovate login accounts require a PickMyTrade Token for authentication.

- Risk Percentage vs. Quantity Multiplier:

- Use risk percentage if you want the system to calculate position sizes automatically based on account balance and stop loss.

- Use quantity multiplier if you want to manually define contract size scaling.

- The JSON alert structure ensures all accounts receive trade instructions simultaneously.

More Resources #

Want to automate trades on platforms beyond Rithmic, such as Interactive Brokers, TradeLocker, TradeStation, or ProjectX?

Explore all PickMyTrade setup guides

Using Tradovate instead?

View the Tradovate automation guide