1. Introduction #

A Trailing Stop Loss (TSL) is an advanced risk management feature that automatically adjusts the stop loss as the market moves in your favor. Unlike a fixed stop loss, it dynamically locks in profits while still allowing the trade to remain open. This approach is ideal for traders who want to ride trends while protecting gains.

This document outlines how to configure various types of trailing stop losses—including Dollar (from Entry Price), Percentage, Ticks, and Total Profit/Loss. Each section includes setup details, formulas, and real-world examples to help you apply the feature effectively.

For a visual walkthrough, refer to the accompanying video:

How Trailing Stop Loss Works #

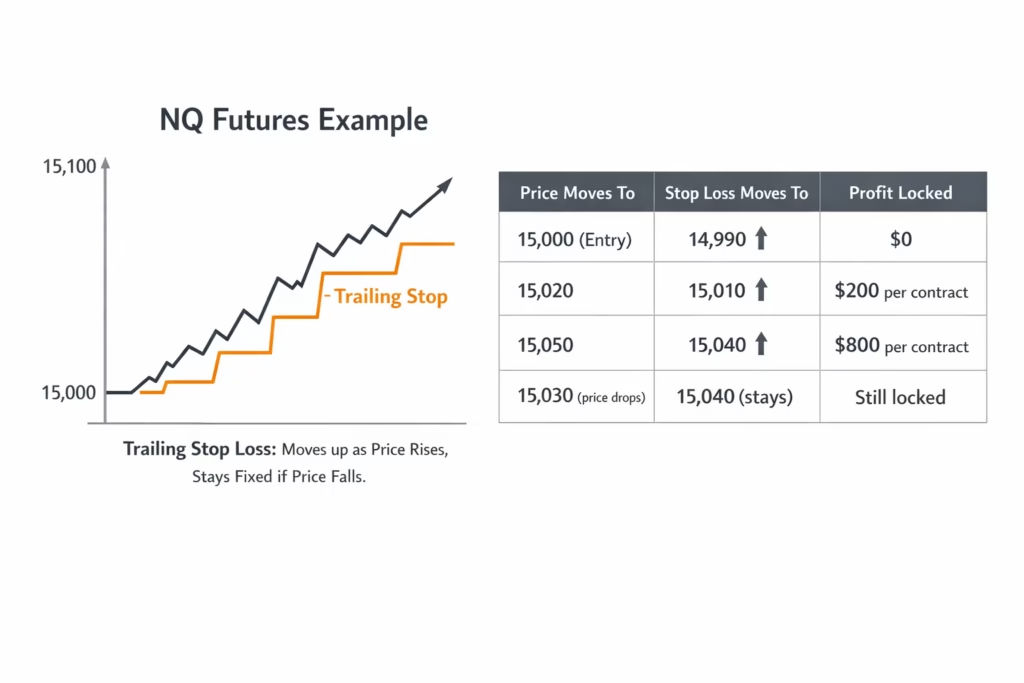

Imagine you bought NQ at 15,000 with a 10-point trailing stop:

👉 Key rule:

Your stop only moves UP, never down. Once profit is locked, it cannot be lost.

2. Trailing Stop Loss Settings #

(Common for Dollar (From Entry Price), Percentage, Ticks, Total Profit/Loss)

2.1 Symbol and Quantity #

- Symbol: NQ

- Quantity: 10 Contracts

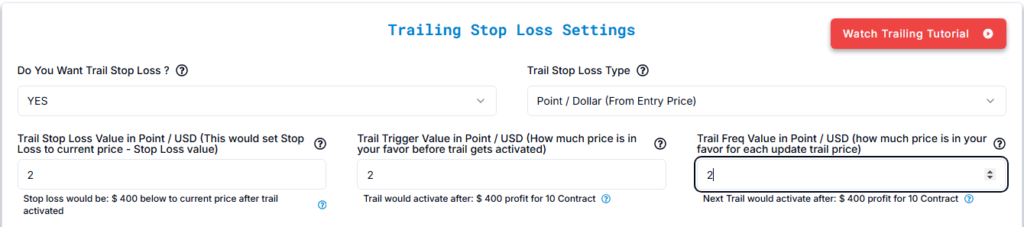

2.2 Trailing Stop Loss in Point / Dollar (From Entry Price) #

2.2.1 Trail Stop Loss Configuration #

- Do You Want Trail Stop Loss?:

- Option: YES / NO

- Purpose: Enables or disables the trailing stop loss feature.

- Trail Stop Loss Type:

- Type: Point / Dollar (From Entry Price)

- Trail Stop Loss Value:

- Value: Points / USD below the current price after the trailing stop activates

Example:

- Current Price: 100

- Trail Stop Loss Value: 20 points

- Once activated, the stop loss will always stay 20 points below the current price.

- Trail Trigger Value:

- Value: How much the price must move in your favor before the trailing stop activates

Example:

- Trail Trigger Value: 5 points

- Price must reach 105 (100 + 5 points) for the trailing stop to activate.

- Trail Frequency Value:

- Value: How much the price must move in your favor for each trailing stop update

Example:

- Trail Frequency Value: 2 points

- Once the trailing stop activates at 105:

- At 105: Stop loss sets to 105 – 20 = 85

- At 107: Price moves up 2 points → Stop loss adjusts to 107 – 20 = 87

- At 109: Another 2-point move → Stop loss updates to 109 – 20 = 89

- If the price reverses and hits 89, the position closes and locks in the profit/loss.

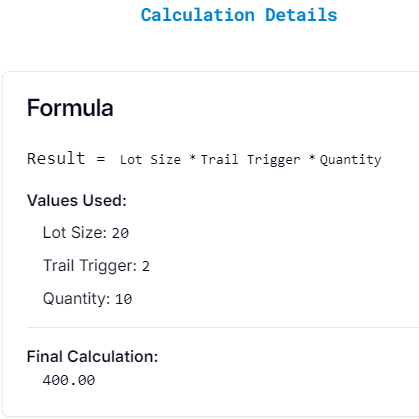

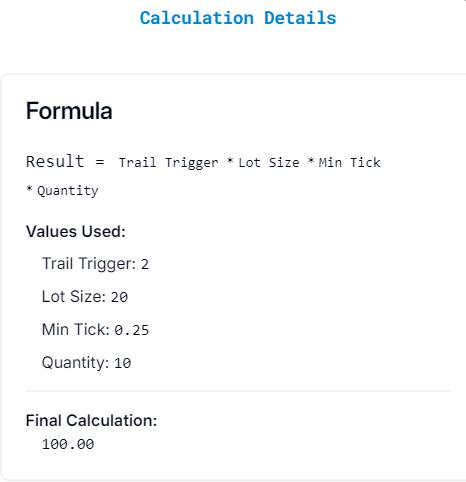

2.3 Calculation Details for Point / Dollar #

To help users each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) includes a small question mark (?) icon.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula Used

- The Values Entered by the User

- The Final Calculation Result

Trail Trigger in USD Calculation:

- Formula: Result = Trail Trigger USD × Lot Size × Quantity

- Example Calculation: 2 × 20 × 10 = $400.00

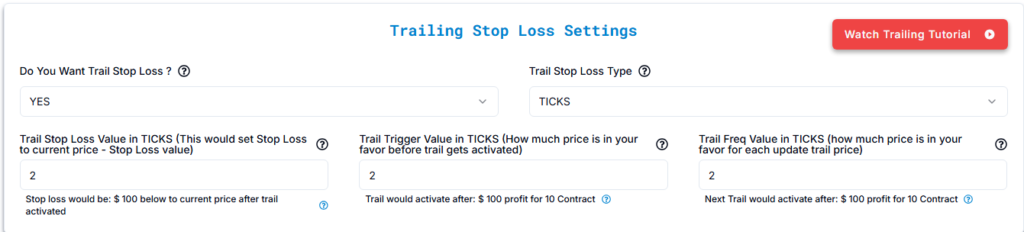

2.4 Trailing Stop Loss in Ticks #

2.4.1 Trail Stop Loss Configuration #

- Do You Want Trail Stop Loss?:

- Option: YES / NO

- Purpose: Enables or disables the trailing stop loss feature.

- Trail Stop Loss Type:

- Type: TICKS

- Trail Stop Loss Value:

- Value: Number of ticks below the current price after the trailing stop activates

Example:

- 1 Tick Value: $10 per contract

- Trail Stop Loss Value: 8 ticks

- Once activated, the stop loss will always stay 8 ticks below the current price.

- Total Loss for 10 Contracts: 8 ticks × $10 × 10 = $800 total loss

- Trail Trigger Value:

- Value: How much the price must move in your favor (in ticks) before the trailing stop activates

Example:

- Trail Trigger Value: 10 ticks

- In this case, the trailing stop will only activate when the price moves 10 ticks in your favor.

- Total Profit for 10 Contracts: 10 ticks × $10 × 10 = $1,000 total profit

- Trail Frequency Value:

- Value: How often the stop loss updates in ticks (i.e., how much price must move in your favor for each trailing stop adjustment)

Example:

- Trail Frequency Value: 2 ticks

- Once the trailing stop activates:

- At 10 ticks in profit: Stop loss sets to Current Price – 8 ticks

- At 12 ticks in profit: Price moves up 2 ticks → Stop loss adjusts by 2 ticks

- At 14 ticks in profit: Another 2-tick move → Stop loss updates again

- If the price reverses and hits the adjusted stop loss → The position closes, locking in the profit or loss

- Example Profit: 2 Ticks = $100 total profit for 10 contracts

2.5 Calculation Details for Ticks #

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula Used

- The Values Entered by the User

- The Final Calculation Result

Trail Trigger Calculation:

- Formula: Result = Trail Trigger × Lot Size × Min Tick × Quantity

- Example Calculation: 2 × 20 × 0.25 × 10 = $400.00

When Should You Use Trailing Stop Loss? #

Good for: #

- Trending markets

- Strategies that catch big moves

- Trades without a fixed take-profit

- Automatically locking in gains

Not ideal for: #

- Choppy or sideways markets

- Very small scalps

- Strategies with fixed profit targets

Recommended Settings by Trading Style #

| Style | Trail Trigger | Trail Distance | Trail Frequency |

| Scalping | 5 ticks | 3 ticks | 2 ticks |

| Day Trading | 15 ticks | 10 ticks | 5 ticks |

| Swing Trading | 50 ticks | 30 ticks | 15 ticks |

These are starting points, not rules. Always test in a demo account.

More Resources #

Want to automate trades on platforms beyond Rithmic, such as Interactive Brokers, TradeLocker, TradeStation, or ProjectX?

Explore all PickMyTrade setup guides

Using Tradovate instead?

View the Tradovate automation guide